How to Calculate Maintenance (Alimony) in New York

In today’s Divorce Academy video, Kevin discusses how to calculate maintenance (alimony) in New York.

For more great information, tips and insights about Divorce Mediation and the Divorce Process in general, check out our podcast, The Divorce Rulebook Podcast.

Video Transcript:

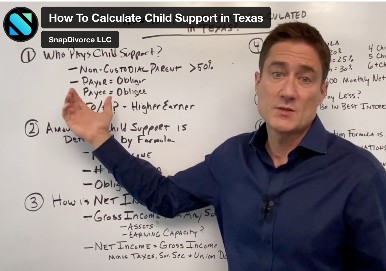

Hi Everyone. Welcome to Divorce Academy. I’m Kevin Handy and I’m one of the New York Divorce Mediators here at SnapDivorce. In today’s Divorce Academy video, we’re going to talk about how maintenance or alimony is calculated in New York.

There are Several General Things You Should Know About Maintenance (Alimony) in New York

We’ll start off by going over some general things you should know about maintenance in New York. And then I’ll go over some sample calculations. I think you’ll find it pretty helpfully if you are wondering how your alimony or maintenance is going to be calculated.

Alimony is Called “Maintenance” in New York

The first thing you should know is that in New York maintenance and alimony or spousal support are the

Maintenance is a payment from one spouse to the other, both during (pendent lite), and after the couple is divorced. Maintenance is deemed appropriate when there is a significant disparity in income between the two spouses filing for divorce. The purpose of this is to assist the spouse that has a lower income in becoming financially independent.

Maintenance is Always Paid by the Higher-Earning Spouse in New York

There are Three Types of Maintenance in New York: Spousal Support, Temporary or Pendente Lite Maintenance, and Post-Divorce Maintenance

There are three types of maintenance in New York. There’s spousal support, temporary or pendente lite

Spousal support is pre-divorce maintenance. Maybe someone moves out of the marital residence, but there’s no divorce filed. Maybe it’s a trial separation. Then the lower-earning spouse can go out and seek spousal support.

During the pendency of the divorce – once a divorce has been filed – then it’s called temporary or pendente lite maintenance.

Then after the divorce is over, it’s post-divorce maintenance.

Just different names, basically the same thing.

In New York Maintenance (Alimony) is Calculated Pursuant to a Two-Step Formula

In New York, maintenance is based on a formula. That formula is dependent on the parties’ incomes and if they have children, and it’s a two-part or two-step formula.

If you’re confused about the process a divorce mediator in New York can help you with the calculations.

The formula itself is relatively simple. But I note that the issue of what the parties’ incomes actually are is where many of the issues are going to come up. For example, is someone running their own business? What are they actually making? Is someone not working up to their earning capacity? Should someone be working? Those sorts of issues are what couples tend to argue over.

Even though the maintenance formula is going to seem pretty simple to you, or relatively simple, know that there is a lot of room for argument in what someone should or should not pay. I’m also talking about deviations, which can also be a source for argument or challenges to the amount of maintenance.

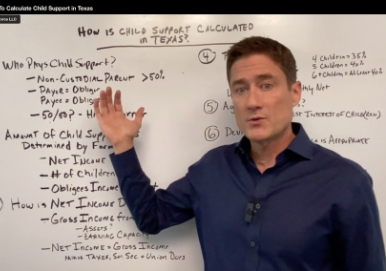

There are Two Formulas to Calculate Maintenance (Alimony) in New York: One for Couples With Children and One for Couples Without Children

The law contains two formulas: One for couples with children and one for couples without children. These

Like I said before, the formula is different for marriages where there are children or no children. By children, I mean children who are going to be subject to a support order, which are generally unemancipated children under the age of 21. Unemancipated means they are not married themselves or in the military or self-supporting.

The Formula to Calculate Maintenance (Alimony) in New York is Based on the Parties’ Net Incomes

In more complicated cases, the law will allow you to add or subtract a specific amount of your income when determining your income. This is only permitted if the circumstances require it, such as a spouse being underemployed, or if a spouse is receiving other personal benefits from employment such as the use of a car.

Once gross income is determined, New York permits the subtract certain taxes. The income they are going to use to calculate maintenance in New York is going to be gross income minus social security, Medicare and some local taxes. They are not taking off state of federal taxes to reach the net income. So just be aware of that. So when you are talking gross income you are just taking away the Social Security, Medicare and some local taxes.

The Formula to Calculate Maintenance (Alimony) in New York Only Considers Income to $184,000

The next thing to know is that there is a $184,000 limit on income that is subject to the formula. If their

How To Calculate Maintenance (Alimony) in New York

If You Don’t Have Children, Calculate Maintenance (Alimony) in New York Using the Formula for Couples Without Minor Children.

Here is the maintenance formula for couples without minor children. I mentioned it is two-part. You have

Without minor children you take 20% of the lower-earning spouse’s net income and 30% of the higher-earning spouse’s net income. In this example we have $50,000 for the lower-earning spouse’s income. 20% of that is $10,000. And we have $100,000 for the higher-earning spouse, and 30% of that is $30,000. Then you subtract $30,000 minus $10,000 and that equals $20,000. Hold that for a minute.

Part 2, you take their combined income: $50,000 plus $100,000 equals $150,000. And then you take 40% of their combined income. 40% of $150,000 is $60,000. Then you take that number, the $60,000, and you subtract the lower-earning spouses net income.

So here we’ve got $60,000 minus $50,000. That equals $10,000.

So, in Step One we got $20,000 and in Step 2 we got $10,000. You take the lower of those two numbers and that is going to be the annual maintenance number. $10,000 divided by 12, you are looking at about $833 per month.

Considerations About Waiving Maintenance (Alimony) in New York

And, by the way, for everyone who thinks, “I don’t want to pay maintenance . . . I don’t want to tip my spouse off.” Your spouse knows about maintenance and alimony. Everyone knows about it. You are not actually going to be hiding anything from them. If they want to waive it, or if you want to discuss it, that’s great. In fact, if it is a potential maintenance case, you have to discuss it because, when you get to court or in the marital settlement agreement, you’re going to have to address whether there is going to be maintenance or not.

If You Have Children, Calculate Maintenance (Alimony) in New York Using the Formula for Couples With Minor Children.

Moving onto the formula. With minor children, the formula is similar, the percentages are just a little

With minor children, you take 25% of the lower-earning spouse’s net income. So here it’s $50,000. 25% of that is $12,500. Take 20% of the higher-earning spouse’s income. $100,000 times 20% equals $20,000. The difference is $7,500 ($20,000 – $12,500). So you hold that number.

Then use the same Step 2 formula as above. You take the combined income of $150,000 times 40% equals $60,000. $60,000 minus the lower-earning spouses net income of $50,000 equals $10,000.

So in this example, the $7,500 is lower, so that is going to be the annual maintenance. $7,500 divided by 12 is $625 per month. That would be the monthly maintenance order in that case. Of course, the reason it is lower is because then you go on and calculate what the child support would be.

The General Rule for When There Will be a Maintenance (Alimony) Order in New York

Determine How Long Maintenance (Alimony) Will Last in New York

Then, of course, everyone wants to know what the duration is. New York has guidelines as to the duration

One thing to keep in mind with regard to all of the calculations is that they are all subject to deviation based on different factors. I mentioned them before, ages, health, contributions to the marriage, differences in earning capacities. There is also a catch-all, so the court can really take into consideration anything, so there is a lot of room for deviation, especially in higher-income cases.

New York Did Not Change How Maintenance is Calculated as a Result of the 2019 Changes to the Federal Tax Code making Maintenance (Alimony) Non-Deductible

As you have probably noticed by now, maintenance guidelines in New York are purely mathematical and do not take into account the individual circumstance of each family.

This often results in maintenance awards that make little financial sense in reality. Fortunately, the law allows couples to opt-out of using the maintenance guidelines calculations in private agreements, and such agreements do not need to be approved by the courts. In mediation, a couple is entirely free to make their own decisions regarding maintenance. The couple can determine if maintenance is appropriate in their situation and if so, customize the amount and duration so that it works for their own unique family needs and circumstances.

So that is how you calculate maintenance in New York. I hope this has been helpful, and I’ll see you next time on Divorce Academy.

Related Articles

Don’t blow

everything for

the sake of

revenge.

Find out how SnapDivorce® can help you simplify your divorce.